Personal loans are a great option to meet any financial emergency as they do not require any collateral as security and lends easily without many formalities. Though infamous for being expensive, a personal loan if managed properly can significantly help in bettering one’s credit score. However, it is also true that a good credit score is needed to take personal loans in the first place. But, it should be noted that credit score is not the only thing that lenders consider to determine the credibility. Some lenders grant a personal loan to borrowers with ‘fair’ score if other criteria are met successfully.

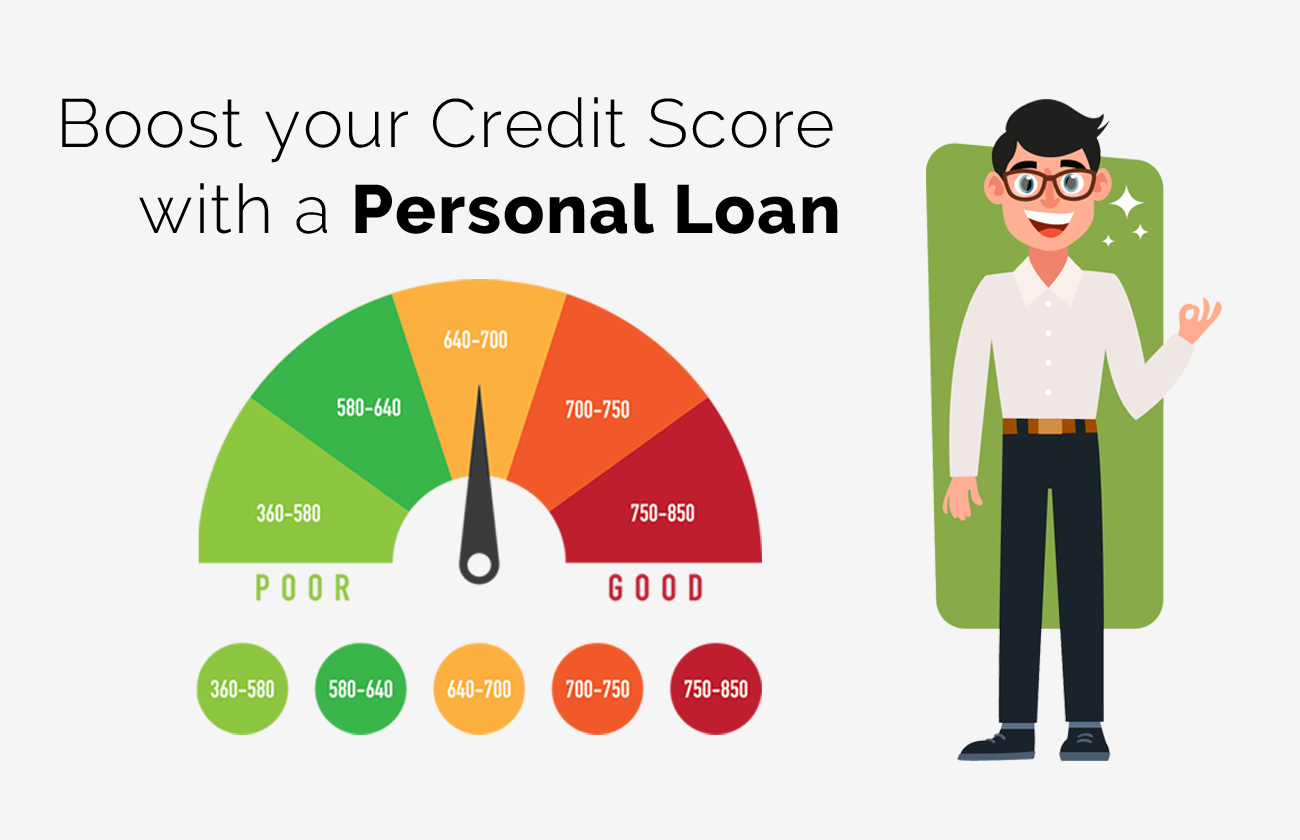

As a matter of fact, one must be aware of the different ranges of credit score before applying for a personal loan.

| RANGE | GRADE |

| -1 | No credit history |

| 0 | Credit history available for less than 6months |

| Less than 500 | Bad |

| 551-649 | Poor |

| 650-699 | Fair |

| 700-749 | Good |

| 750 and above | Excellent |

The credit score is calculated on five prime factors viz. credit history, length of the credit period, total debt owned, types of loans taken and new debt.

Personal loan acts as a great tool to improve one’s credit score. Taking a personal loan is one of the easiest ways to clear old dues. Once you are through with your old dues, you can restart the debt payment with new terms which eventually helps in improving payment history and thereby improving your credit score. Also when one applies for the loan, the EMI is decided upon by the lending institution on the basis of your repayment capacity. As there is no burden, one is liable to pay the instalments on time which eventually will be a good addition to your credit history and improve your credit score.

Things to Keep in Mind While Taking a Personal Loan to Boost Your Credit Score:

- Do not apply for multiple loans: If you already have multiple loans going on, applying for one more reflects you as a credit hungry person in front of the lender. Every time, one applies for a loan, a hard enquiry is initiated on your credit report which impacts your credit score. Too many hard enquiries are negative for a borrower.

- Decide the amount carefully: Don’t just take the loan for the heck of it. Assess the need and then take the loan accordingly. Apply for the amount you actually need. If you are taking a personal loan to boost your credit score, the loan amount becomes a very crucial factor.

- Make regular payments: Taking a personal loan for credit improvement will go waste if you default on EMI payments or delay them. Being unsecured in nature, personal loans impact your credit score the most. So, make sure to pay the EMIs on time.

- Do not pre-pay your loan: To boost your credit score, do not pay before your loan matures as longer credit history is considered better. So if you keep making regular payments till a longer tenure, your credit score will be better.

- Do not apply multiple times for one loan: Don’t rush to make more loan application as your credit score begins to impact by your each application’s enquiry every time. In the hunger of money, people usually apply at multiple places to open avenues for quick money, but that may hamper your enquiries in cibil report and banks may find it difficult to fund you for any type of loans. The offers might look tempting but it can affect your credit score in a bad way.

- Do not rush to other debts: Don’t take more loans above your financial capacity to repay it back as your credit score begins to improve upon your paying of monthly instalments on time, whereas more burden on loan repayment may sometimes lead to delay in repayment of EMI and hence can reduce your credit score. With timely repayment, the credit score improves and opens avenues and eligibility for various types of loans.

A personal loan is thus not a key to financial emergencies but is also an excellent way to enhance your credit rating. Don’t go overboard and act smartly by consolidating your debts or take a personal loan for an amount that you can easily pay off.